Charting a bright course: The future of aviation engine engineering

A modern commercial airplane engine includes between 30,000-50,000 parts. Every single one of those parts must be expertly designed and manufactured to ensure the performance and reliability of the engine. These engineering marvels are essential to life as we know it.

Approximately 40.1 million flights will be completed in 2024, or an average of 110,000 flights per day. With 25,578 aircrafts currently in service worldwide, these wonders of engineering play an indispensable role in our interconnected world. Global tourism and travel thrive on safe and affordable flights, while international trade relies on fleets of airplanes to transport goods across continents. Aircraft also serve as lifelines during crises, delivering aid to disaster-stricken regions and conflict zones, while nations depend on military jets for national security.

The significance of aircraft engines is reflected in their rising substantial economic footprint. The aircraft engine market was valued at $80 billion in 2021, and projections indicate it will rise to over $97 billion by 2026.

This growth is fueled by several factors. A substantial reason is that many developing nations’ economies have grown, notably India and China, leading to a larger middle-class population with greater disposable income. These increasingly affluent citizens want to travel abroad in greater numbers than ever. Executives in the industry have emphasized that boosting engine numbers is necessary to guarantee airlines can continue operating at full capacity. Growth is also caused by the pressing need for increased military aircraft due to conflicts and uncertainty around the world. However, building aircraft engines to meet this increasing demand is complex and difficult; producing these engines requires advanced technology and specialized expertise, which only a few countries possess. To address these challenges, companies like Hanwha are stepping up their expertise in aero-engine engineering to help reinforce the aviation industry.

Why aircraft engine development is so challenging

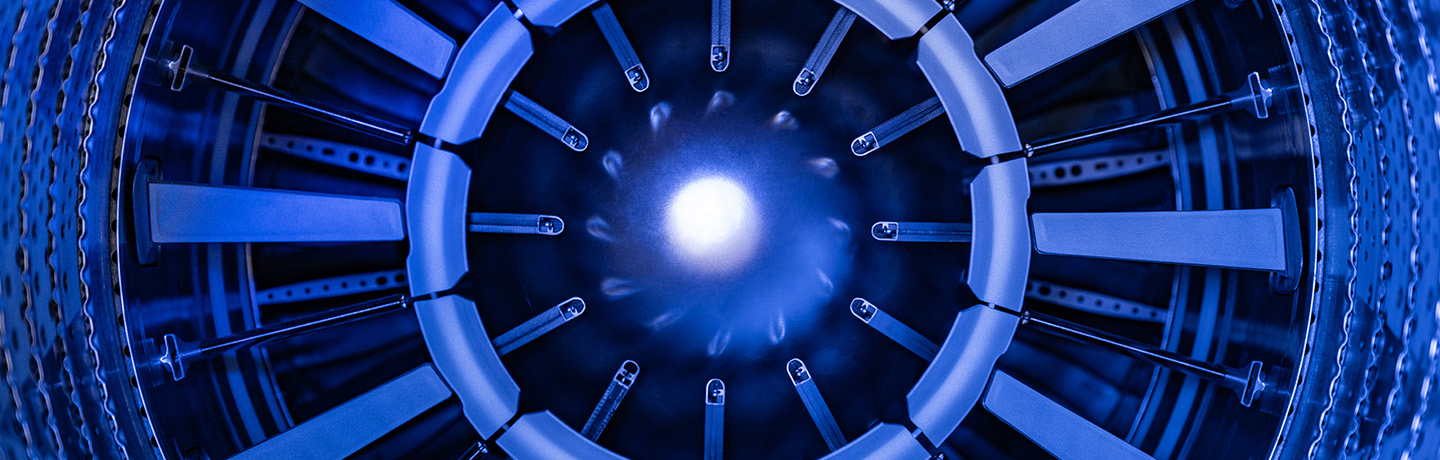

Aircraft engines demand precise and robust engineering to withstand the intense pressure, temperatures, and wear they endure throughout their operational lifespan. Rigorous safety regulations govern aircraft production, making aircraft engines even more difficult to produce.

Although aircraft engines vary, they all operate through the same four steps: intake, compression, combustion, and exhaust. Air is first drawn into the engine, which is then compressed and forced into the combustion chamber where the compressed air is heated and moves through the turbine. Finally, the hot air is expelled through the exhaust generating thrust. The type of engine used depends on the specific needs of the aircraft.

The most common engines used in airplanes are turbofan and turbojet engines. Turbofan engines are commonly used in civil aviation, such as airliners. They prioritize efficiency and quiet operation at subsonic speeds. Turbojet engines, once predominantly used in early fighter jets, deliver immense power but are noisy and less fuel-efficient. Modern fighter jets now use turbofan engines due to their improved efficiency and performance. Today, turbojet engines are primarily employed in drones and guided weapon systems.

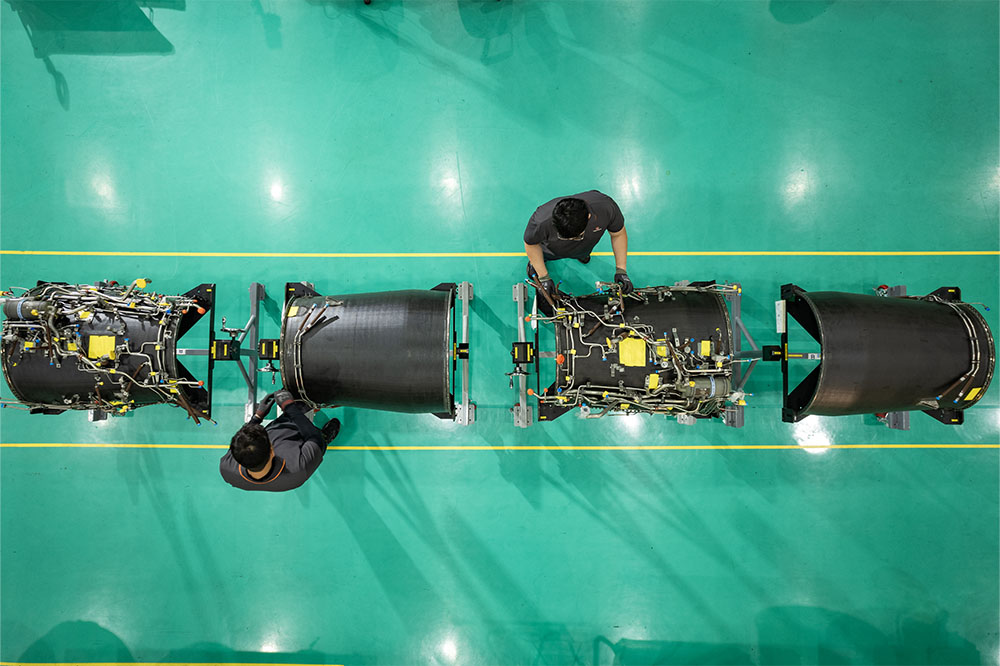

An aero-engine at Hanwha Aerospace’s Changwon facility

Aircraft engines pose several engineering challenges. They must be compact enough to fit on an aircraft while also producing enough thrust for flight. Aircraft engines must also withstand intense temperatures and large pressure changes. Other considerations are reliability, fuel efficiency, and environmental impact.

This process demands substantial financial investment, extensive and often proprietary knowledge, and access to specialized materials. Due to these complexities, only a select few companies possess the capability to create their own engines entirely in-house. The technological prowess is concentrated in nations with advanced aerospace industries, such as the United States, the United Kingdom, and France. There are stringent export and import restrictions, making it difficult for other nations to acquire the necessary technology and specialized skills.

Two workers assemble an aero-engine at the Hanwha Aerospace's Changwon facility

Setting the groundwork for the future

Considering the high demand for aircraft engines and the limited number of companies able to produce them, acquiring this valuable technology is globally coveted. A notable example of a company moving towards this goal is Hanwha Aerospace, which is leveraging its experience and expertise to develop its own engines. Through mastering in-house engine production, Hanwha will strengthen the overall aerospace industry by increasing the number of engines available to the market.

Hanwha is venturing further into the engine business, building on its 45 years of experience in licensed production of aircraft engines in collaboration with industry giants such as General Electric (GE), Pratt & Whitney, and Rolls-Royce. Over this period, Hanwha has produced over 10,000 aero-engines. These engines have powered various fighter jets and South Korea’s domestic multipurpose helicopter Surion. Due to its expertise in building complex and advanced engines, Hanwha Aerospace secured a contract in 2024 with South Korea’s Defense Acquisition Program Administration (DAPA) to manufacture engines for KAI KF-21 fighters. Hanwha has expanded its cutting-edge facility in Changwon, South Korea, to support the production of the KF-21 engine. The end goal is to capitalize on its decades of experience and produce the advanced aero-engine entirely with its own technology.

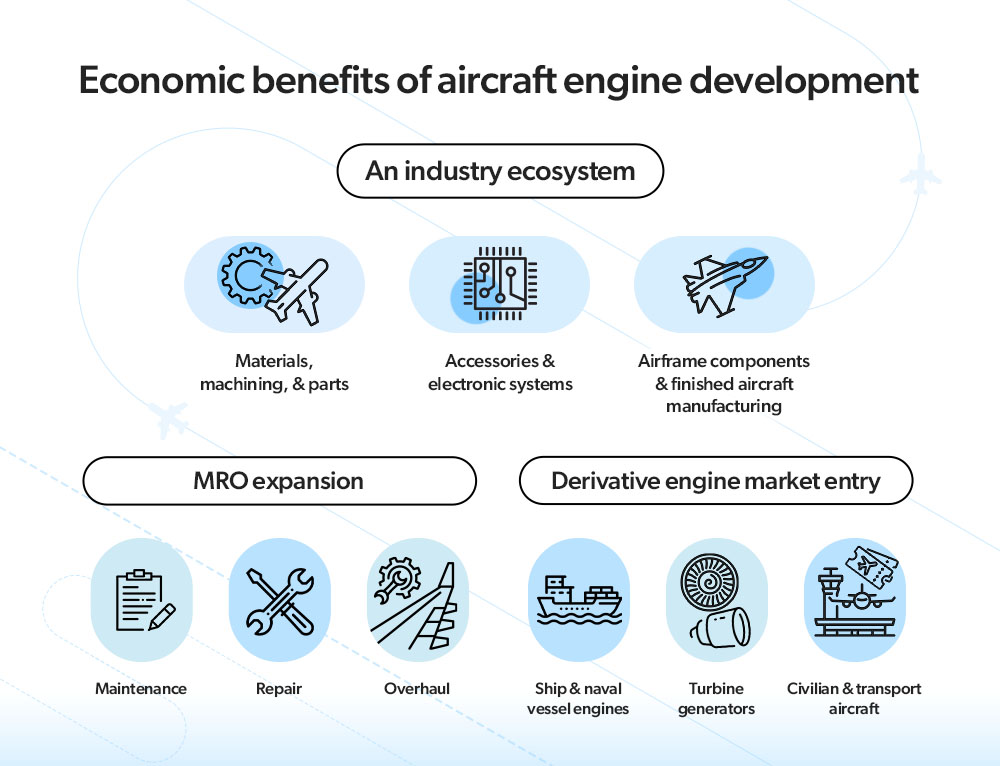

The advantages of securing in-house gas turbine engine technology extend far beyond the ease of manufacturing alone. Once Hanwha succeeds in producing the core of an aircraft engine, it can build on this advanced technology to create engines for civil and transport aircraft, ships and naval vessels, generators, and other civilian systems.

Additionally, the development of advanced engines of this nature creates a comprehensive industry ecosystem. This includes parts, materials, electronic systems, and specialized technologies, fostering growth and innovation across multiple sectors.

Securing proprietary technology for these engines also has wider implications for the aviation industry, as Hanwha will have the flexibility to produce and supply its engines to customers worldwide.

But more engines alone are not sufficient for preserving a functioning aviation industry; maintaining the performance of all engines in use is paramount.

What is MRO and why is it essential?

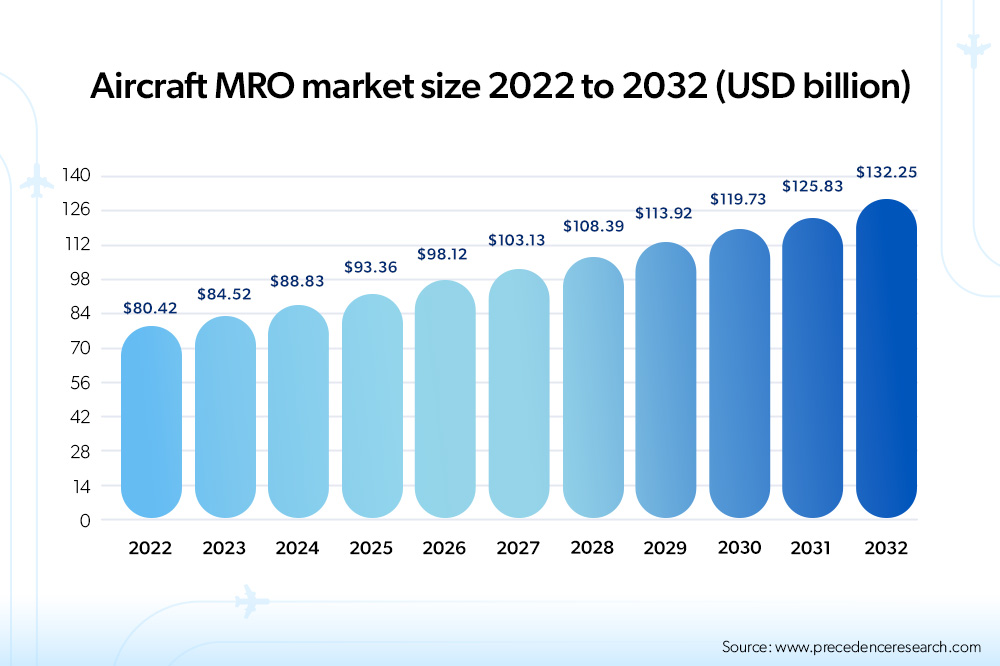

MRO services are an essential component of the aviation industry — a behind-the-scenes process that ensures smooth operations. Like car engines, aero-engines also require regular maintenance and repairs. Effective aircraft MRO guarantees the safety of aircraft while simplifying and streamlining maintenance procedures.

As the aviation industry grows, so will the MRO market. There are immediate challenges, however. Supply chain issues and backlogs threaten to ground planes, emphasizing the urgent need for robust MRO practices that keep engines working safely and effectively, so that airlines can keep their fleets flying. Once Hanwha has advanced aero-engine production under its belt, it will be able to advance rapidly into MRO services, increasing its contribution and presence in the aviation industry.

To directly address the global demand for aircraft engines, Hanwha has also entered the aircraft leasing sector, as leasing is vital for airlines to expand their fleets without significant costs. That is why Hanwha launched Hanwha Aviation in 2024. One short-term goal is increasing its narrow-body engine and aircraft portfolio, targeting over 1,000 assets within the next decade through this new platform.

Innovating the skies: Hanwha’s future in aviation

Aviation is essential to modern life, facilitating tourism, trade, global business, and emergency services. As the demand for air travel rises, so will the demand for aircraft engines. Hanwha is prepared to support this growth by producing more high-quality engines for various types of aircraft, developing its own aircraft engine parts, and providing top-notch MRO services. In an ever-changing aviation landscape, Hanwha’s commitment to innovation ensures a bright future for air travel and Hanwha’s innovative solutions will enhance security and stability in the global aviation sector.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee