How Hanwha is shaping the future of AI in finance

The world of finance has been shaped by continuous technological breakthroughs — digital banking, automated trading, and blockchain, to name a few. But artificial intelligence (AI) represents an even greater shift: a future where financial decisions are not just powered by human expertise but optimized by intelligent systems capable of analyzing big data, predicting market trends, and enhancing risk management in ways once thought impossible.

As AI accelerates the pace of transformation in finance, it also raises critical questions about a sector where security, trust, and ethical considerations are paramount. How do we ensure fairness in automated decision-making? Can AI-driven finance remain stable and secure amid rising cybersecurity challenges? And how do we strike the right balance between innovation and responsible oversight?

The key to answering these questions lies in investing in research and development initiatives that establish a strong foundation for AI-powered tools to be transparent, ethical, and secure. To foster these investments, collaboration between industry leaders, policymakers, and bodies versed in AI regulation will be essential.

The future of finance: Smart, inclusive, and AI-driven

With the global market size of AI in the financial industry projected to grow from $38.36 billion in 2024 to $190.33 billion by 2030, AI is now a defining force in financial services. Banking and insurance stand to gain the most from this shift, with nearly three-quarters of all tasks in these industries ready to adopt some form of automation or augmentation. But AI’s potential extends far beyond streamlining workflows — it is actively reshaping how financial systems operate and how consumers engage with them.

AI’s ability to process large datasets at unprecedented speeds has opened the door to innovations across the board. In finance, these innovations are helping to mitigate the sector’s traditional limitations. For example, Hanwha’s solutions range from portfolio optimization through robo-advisors that use real-time data and predictive analytics to fine-tune investment strategies, to digital personas — profiles that preserve personal data as digital assets. AI also shows promise in offering more precise evaluation of creditworthiness than traditional credit scoring methods, potentially broadening access to financial products for underserved populations.

Yet, as AI finance expands access and efficiency, it introduces new vulnerabilities to a sensitive industry, such as data privacy and identity security. In addition, if not carefully managed, algorithmic bias in credit decisions could exacerbate financial inequities rather than eliminate them.

Addressing these challenges requires a holistic approach, balancing technological innovation with ethical issues and societal considerations. Research plays a pivotal role in understanding AI’s long-term impact — ensuring it not only enhances financial stability but also serves the public good.

Research and collaboration: Powering finance's next era

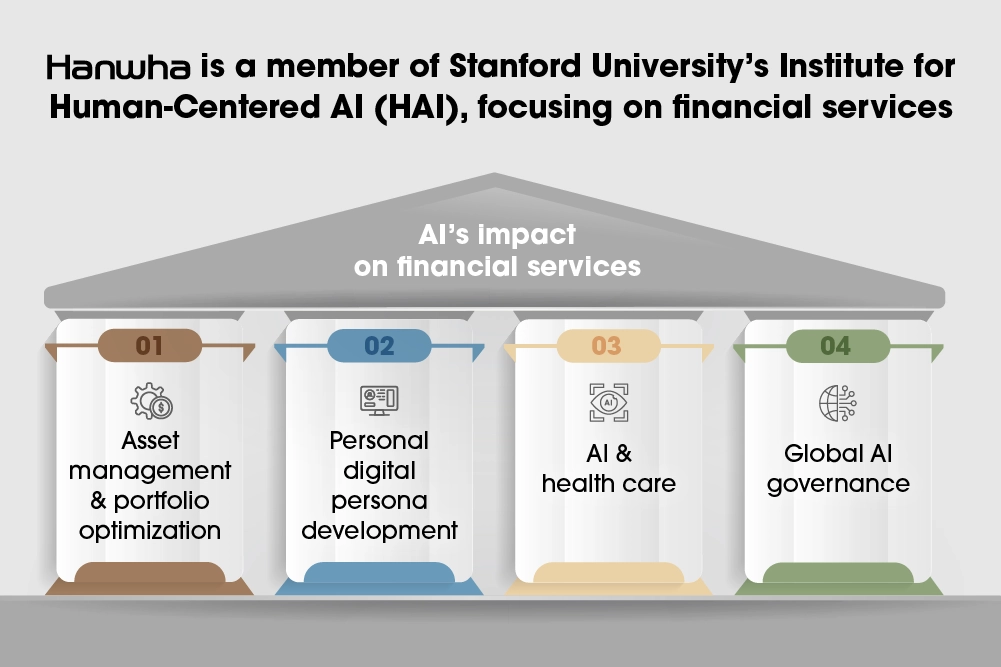

Successful AI deployment requires rigorous research and a commitment to transparency. Historically, research-driven insights have shaped industries, from sustainable fashion to ethical supply chains. Leveraging its expertise across several industries, Hanwha has founded two research centers to explore AI’s full potential and its complexities: Hanwha Life AI Research Center and Hanwha AI Center (HAC). As a member of Stanford University’s Institute for Human-Centered AI (HAI) Corporate Affiliate Program, Hanwha Life AI Research Center is undertaking research related to four key pillars:

- Asset management & portfolio optimization – Developing AI-driven investment strategies by improving risk modeling, minimizing vulnerabilities, and maximizing returns. This ensures individuals and institutions have access to more efficient and resilient financial planning tools.

- Personal digital persona development – Exploring how AI can preserve digital memories as assets, with the potential to integrate them into insurance-linked financial services, allowing individuals to safeguard and pass down their digital legacy.

- AI & health care – Developing personalized healthcare solutions powered by AI, considering the close ties between the life insurance industry and human health; exploring the future development of AI-based health care services that can be incorporated into insurance offerings.

- Global AI governance – Establishing norms and standards for the ethical development, use, and regulation of AI technologies, analyzing the current global landscape of AI governance to ensure that AI advancements uphold human safety, privacy, fairness, and ethical standards.

While the Hanwha Life AI Research Center focuses on understanding AI’s long-term impact on finance and society, the recently established San Francisco-based HAC will serve as a global hub for AI leadership. Brought together by Hanwha Finance (Hanwha Life, Hanwha General Insurance, and Hanwha Asset Management), it will bridge academic research with real-world AI applications and turn insights into deployable, next-generation AI solutions that enhance investment strategies, insurance models, and risk management tools.

To continue fostering initiatives like these, it’s essential for industry leaders, technology innovators, and financial institutions to work closely together. Exemplifying this, Hanwha, which already holds a presence in Vietnam and Singapore, continues to expand its global presence through collaborative partnerships such as those with SBVA and Celadon Partners, announced at the World Economic Forum 2025 in Davos. These skill and knowledge-sharing coalitions share a common goal of building cutting-edge financial solutions that empower and protect individuals.

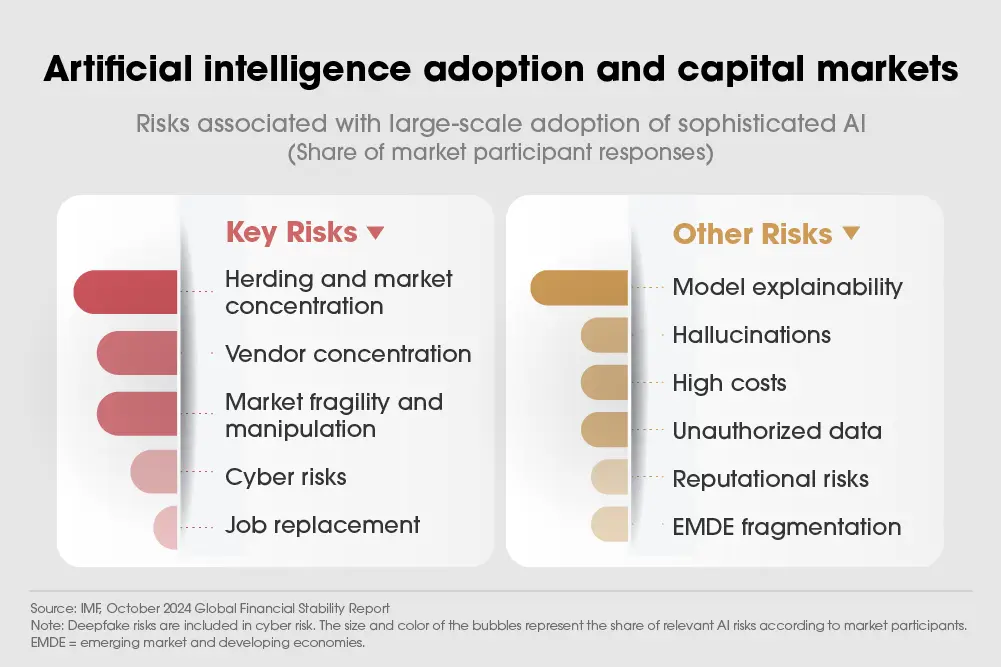

At the same time, HAC’s plan to seek investment opportunities in AI startups further fuels this vision. With the IMF's Global Financial Stability Report citing the industry’s reliance on a few major AI service vendors as a key challenge, ensuring that new players are supported to enter the field reduces the risk of service disruptions and operational issues.

Smarter finance: Why do we need it?

With the IMF’s World Economic Outlook 2025 warning of global market instability and policy disruptions, the need for new, resilient, AI-driven financial systems is more important than ever. With smarter tools, stakeholders can better anticipate risk, enhance their decision-making, and expand financial access to consumers, allowing individuals and businesses to navigate volatility with greater confidence. However, before these tools can be implemented, adequate research must be done to understand their impact — as well as new inequalities and issues.

As AI continues to transform almost all industries, its advancement must be intentional and accountable. The goal is not just innovation for its own sake, but to create systems that promote stability, security, and accessibility — benefitting every part of society. Backed by its historical leadership and emerging finance market expertise, Hanwha remains committed to fostering this transition, driving innovation that builds long-term trust at its core.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee