What’s in a number: 6 insights into Hanwha’s shipbuilding expertise

With global demand for high-value, next-generation vessels rising in line with energy transition efforts, working with trusted partners capable of delivering future-ready maritime vessels has never been more critical.

A leader in the field, Hanwha plays a key role in developing those vessels. In 2024, it ranked Korea’s most-ordered shipbuilder and continues to set the standard for engineering excellence, delivering complex, high-specification vessels that support both economic and energy security.

Thanks to its ability to transport high volume loads over long distances, as well as its cost efficiency in doing so, we already rely on shipping to transport most fuels. However, with demand for alternative fuels rising, that role is expected to grow, to eventually transfer at least half of all net-zero fuels worldwide. But shipping itself ranks as the third largest transport emitter of greenhouse gas, and with its role set to expand further, work must be done to ensure that the vessels themselves run cleaner.

Here, we explore six key figures that highlight Hanwha’s role in this challenge, and why working with experienced shipbuilders is more crucial than ever.

Shipping moves around 90% of global goods, making the industry’s decarbonization an increasing priority. As the need for cleaner, more efficient vessels grows, so too does the demand for shipbuilders capable of the innovation necessary to build new fleets. With more than 50 years of experience and deep expertise gained at its 1,200 acre (4.9 million square meter) Geoje shipyard — equivalent to around 900 American football fields — Hanwha Ocean is the No. 1 provider of container ships globally, accounting for 31.7%* of the market share.

*Based on delivery volume of 17,000+ TEU container ships as of February 2025. Source: Clarksons

Hanwha’s vessels have been ordered from 61 different countries around the world, further boosted by the recent $100 million acquisition of Hanwha Philly Shipyard. A cornerstone of American shipbuilding, Philly Shipyard has delivered over half of all U.S. Jones Act large commercial vessels since 2000. With this historic acquisition, Hanwha is integrating its advanced technologies to enhance operations, expand capacity, and drive new growth opportunities — reinforcing the resilience of the U.S. shipbuilding industry and the maritime supply chain.

Hanwha Ocean reached a key milestone when it became the first Korean shipbuilder to provide maintenance, repair, and operation (MRO) services for the U.S. Navy, securing two contracts in 2024 and reinforcing its growing U.S. shipbuilding presence. This achievement underscores Hanwha’s engineering expertise, world-class shipyard capabilities, and proven ability to meet the rigorous demands of military vessel maintenance.

With a 23.4% market share, about one in four liquefied natural gas (LNG) carriers are built by Hanwha. As of February 2025, Hanwha Ocean received the most orders for LNG carriers worldwide — reinforcing its capacity to empower energy transportation, particularly in the U.S. and Europe. The company also became the world’s first to build and deliver its 200th LNG carrier. By leveraging cutting-edge technology and expertise in LNG carriers and offshore plants, Hanwha is building out its LNG value chain, optimizing energy supply chains and solutions for LNG production, storage, transportation, and power generation.

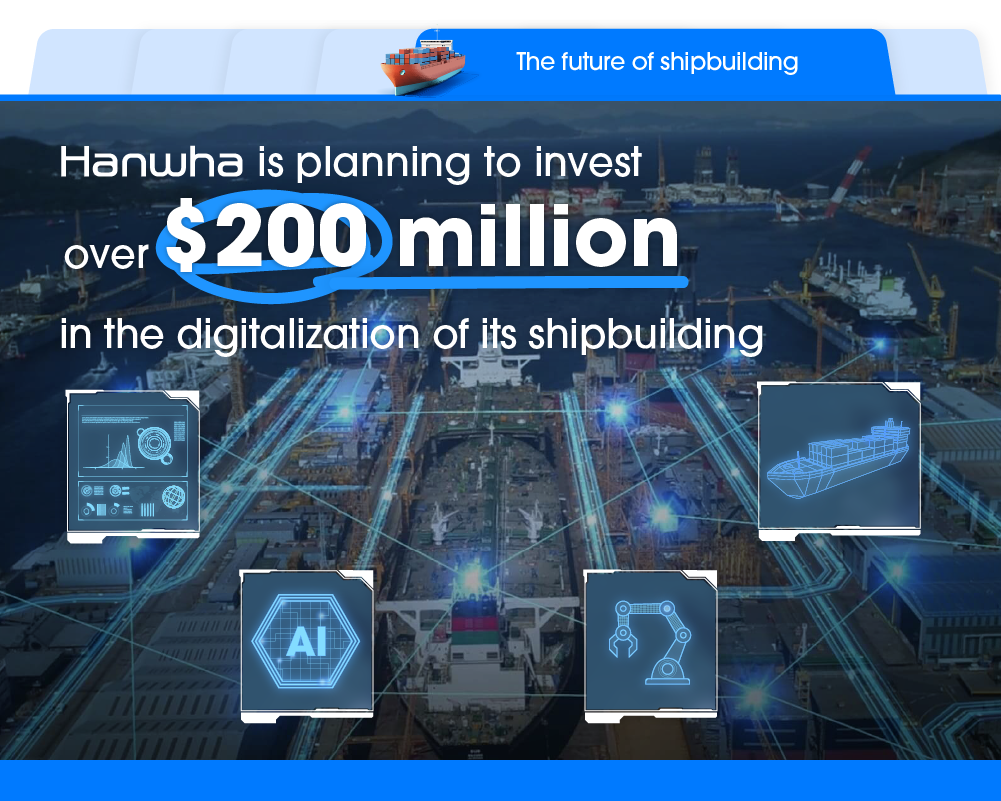

Recognizing the potential of smart technology, Hanwha plans to invest over $200 million into the digitalization and automation of its shipyards and vessels. At Geoje shipyard, Hanwha Ocean is integrating AI, big data, and automation to enhance ship production and safety, and through the HS4 platform, has developed a smart ship system that tracks carbon intensity and optimizes fuel efficiency. These innovations set the stage for a more sustainable and efficient maritime industry.

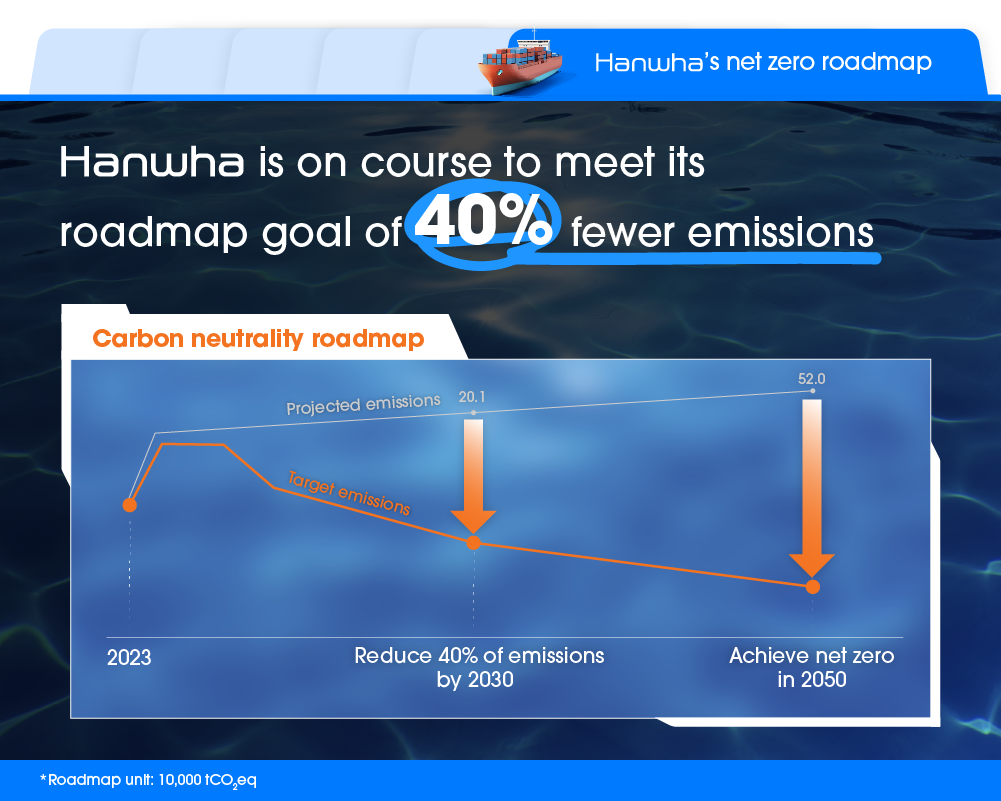

To date, Hanwha Ocean has built 231 lower-emission vessels, including LNG carriers, utilizing cutting-edge dual-fuel and emissions-reducing technologies. This progress aligns with Hanwha’s 2050 carbon neutrality roadmap, driving the transition toward cleaner maritime operations. Taking this further, Hanwha is now advancing toward the integration of ammonia-fueled gas turbines, a transformative propulsion system that will enable the world’s first fully carbon-free ship operation.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee