Hanwha Life

www.hanwhalife.com- 2023 Total Sales

- 10,128 In USD millions

- 2023 Total Assets

- 89,028 In USD millions

Our expertise

- Life insurance, mortgage and personal loans, trust, fund, retirement pension

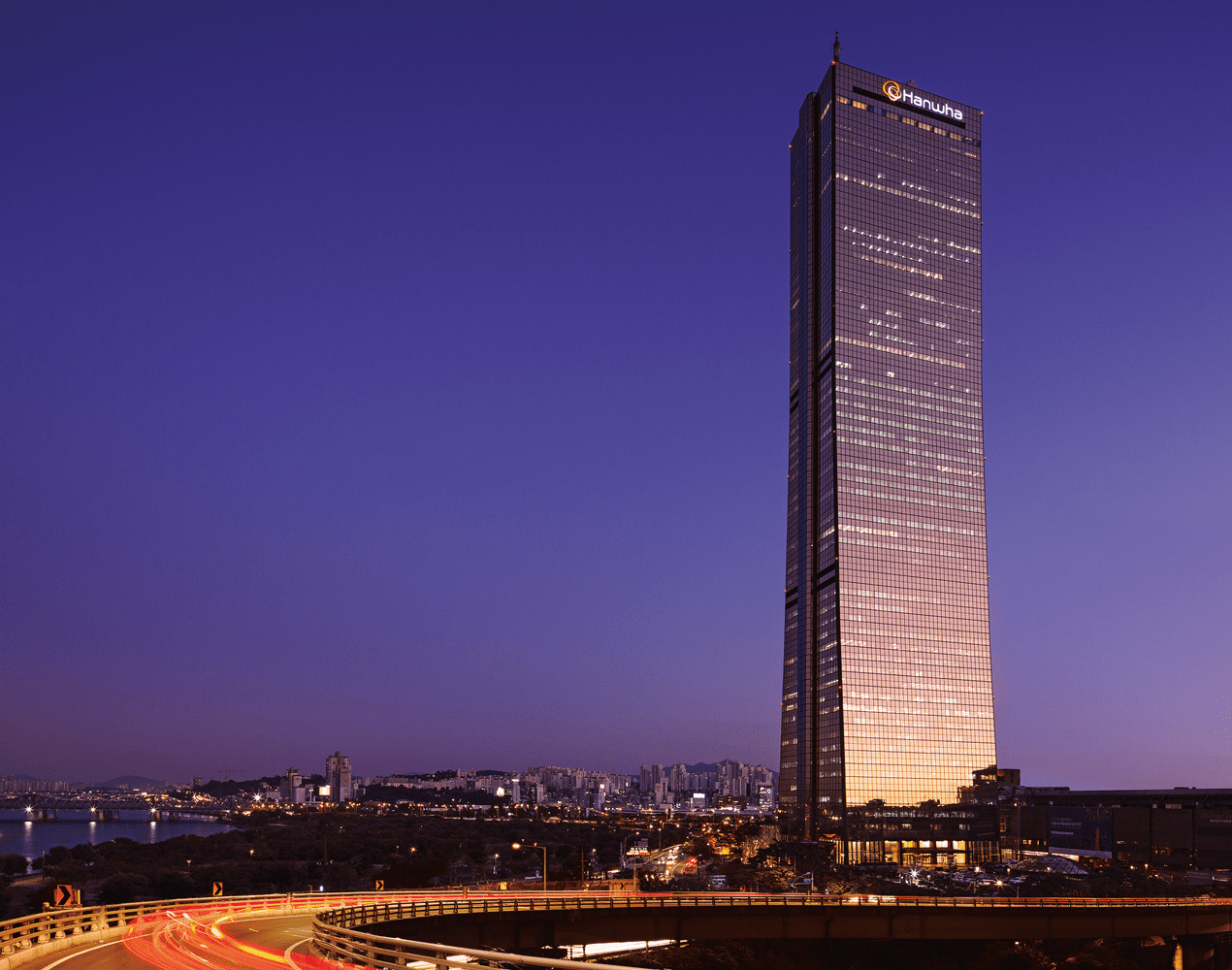

Established in 1946, Hanwha Life is a leading South Korean life insurance company and also the first and longest–standing in the nation. For the past 77 years, we have played a critical role in developing both the industry and the country’s economic growth. In 2023, we proved our robust foundation for growth, reporting total assets of around USD 89.03 billion in line with our commitment to adding innovative products and services that meet a wide range of customer needs.

-

Hanwha Life

Hanwha Life

-

In the insurance sector, we introduced a business model that separated the products and services divisions, leading to the establishment of Hanwha Life Financial Services in 2021. We enhance sales efficiency through the use of two digital platforms: OrangeTree, which provides sales support, and OrangeTouch, which manages customer relationships. Our bold challenges and innovations in launching AI–based automated insurance claim underwriting and a cancer insurance product integrated with cancer care services are leading the industry. In 2023, we fortified our sales channel competitiveness by acquiring People Life, an independent life insurance general agency. We plan to further maximize our sales competency and efficiency by strengthening product development and digital business support capabilities.

Our Center of Excellence (COE) division is contributing to digital innovation and growth in value by providing an unparalleled digital experience in sales channels and marketing platforms while identifying new opportunities for growth. In investments, we seek to increase returns by continually identifying high–yield targets that center on alternative investments. To respond to potential risks, we also implemented a new system in the strategic planning division. With this, we are increasing the contractual service margin (CSM) for new insurance to lay the foundation for future profits or losses, securing a stable risk–based capital (RBC) ratio under the new Korean Insurance Capital Standard, and strengthening ESG management.

In addition, by reshaping our LIFEPLUS brand as a wellness program that goes beyond finance, Hanwha Life is providing customized services that cater to differentiated experiences and life–stage–based customer needs. Through preemptive investment and advancement in financial services based on technologies such as AI and big data, we are enhancing our systematic approach to customer relationship management infrastructure. In addition, we are promoting a consumer–oriented organizational culture and continuously improving our services and processes for consumers. Our efforts were rewarded with Certifications for Excellence in Consumer–Centered Management (CCM) in 2021. Since our first certification in 2007, the Korea Fair Trade Commission has awarded nine consecutive certifications to Hanwha Life.

-

-

Globally, we are committed to helping our subsidiaries drive future growth in their local markets by strengthening the competitiveness necessary for their success. We are pioneering the global financial market by expanding our business overseas to markets like the U.S. and Southeast Asia, establishing our presence in the largest number of global markets among other competitors in South Korea. In Vietnam, for example, we implemented an effective localization strategy and strengthened our nationwide sales network, resulting in great success within the market. Recently, we laid the foundation for a global comprehensive financial company by completing the acquisition of a majority stake in Lippo General Insurance in Indonesia.

In May 2024, we finalized a partial acquisition agreement with Indonesia’s Nobu Bank, becoming South Korea’s first insurance company to enter the overseas banking sector. We will continue to strive forward as a global integrated financial group by providing digital financial solutions tailored to each region and pioneering overseas financial markets, focusing on major Asian, U.S., and Middle Eastern regions.

Hanwha General Insurance

www.hwgeneralins.com- 2023 Total Sales

- 4,244 In USD millions

- 2023 Total Assets

- 13,958 In USD millions

Our expertise

- Long–term insurance, automobile insurance, general insurance, mortgage and personal loans

Established in 1946, Hanwha General Insurance is the first South Korean insurance company entirely funded by domestic capital. Building on customer trust, we provide diverse insurance products and services including long–term, automobile, and general insurance. Today, we’re a major insurer with total assets of USD 13.96 billion and total sales of USD 4.24 billion, as of the end of 2023. Backed by our continuous growth, we are constantly challenging ourselves to pioneer development in new fields and bring satisfaction to customers.

-

-

Hanwha General Insurance is committed to solidifying its position as a specialized provider of insurance solutions for women while ensuring internal stability by securing steady insurance and investment returns. We strive to create greater value for women by offering differentiated products and services tailored to female customers while boosting our competitiveness in customer access channels. Additionally, by moving beyond traditional frameworks and embracing change and innovation, we aim to deliver sustainable value and establish ourselves as a world– class global insurance company that meets the evolving needs of the modern era.

In June 2023, we established the LIFEPLUS Femtech Research Institute to fulfill our vision of being an insurer that fully understands and recognizes the needs of women, with the aim of contributing to the betterment of women’s lives and health. For research on women’s health and life–cycle–based needs, we are working with an advisory group composed of experts in each field to study related industry trends and identify preventive healthcare measures. In addition, we are conducting various activities aimed at providing practical information to our customers. As a leading wellness partner in the areas of coverage related to women’s needs, including those during pregnancy and childbirth, we are carrying out multiple initiatives to alleviate the risks stemming from the country’s low birth rate and aging population. For example, we have launched special agreements to double serious disease coverage for five years after childbirth, and to delay payment of insurance premiums during childbirth and parental leave in line with feedback we have received from our female customers. These efforts were selected as best practices by Korea’s Financial Supervisory Service in recognition of our contribution to providing solutions for social problems such as the low birth rate.

By providing tailored financial solutions and services that speak to the needs of female customers at every stage of their life, Hanwha General Insurance aims to set new standards as a financial leader in women’s wellness.

Hanwha Asset Management

www.hanwhafund.co.kr- 2023 Total Sales

- 101 In USD millions

- 2023 Total Assets

- 11,154 In USD millions

Our expertise

- Collective investment fund, discretionary investment

Founded in 1988, Hanwha Asset Management has grown into a comprehensive asset management company that offers a full range of financial instruments, including stocks, bonds, exchange–traded funds (ETFs), real estate, infrastructure, and private equity/venture capital (PE/VC) in both domestic and overseas capital markets. Guided by our customer–first principle, our professional staff brings unparalleled expertise in operating highly organized systems across all areas, including product development, research, compliance, and risk management. As of the end of 2023, we were one of South Korea’s top asset management companies, recording USD 78.78 billion in assets under management (AUM).

In July 2024, Hanwha Asset Management rebranded its existing ETF brand, ARIRANG, to “PLUS” to deliver future value through investment products focused on customer asset protection, technology, and innovation. The PLUS K-Defense ETF, launched in 2023, achieved the highest return in the domestic ETF market in 2024, with a return of 62.21% as of the closing price on October 31, driven by the strong export performance of the South Korean defense industry. The net asset value of the PLUS K-Defense ETF has grown to around USD 193.89 million. Building on this success, the ETF is set to be listed on the New York Stock Exchange.

-

-

Our alternative investment business, including PE/VC, infrastructure, and real estate, has also continued to grow, surpassing USD 15.51 billion in AUM as of the end of September 2024. The PE/VC business achieved particularly significant growth, with approximately USD 4.65 billion in AUM as of the end of 2023. Additionally, we have obtained a REIT AMC license from South Korea’s Ministry of Land, Infrastructure, and Transport, and entered the REIT business in the first quarter of 2023.

Based on our accumulated capabilities in the domestic market, Hanwha Asset Management is advancing as a global asset management company, operating businesses in the U.S. and Singapore. Our subsidiary in the U.S. strengthened its market position in 2023 by launching a local alternative investment fund, while our subsidiary in Singapore is being utilized as a key hub for expanding into the Asian market.

Additionally, we are focusing on expanding digital finance. In 2021, we launched the PINE app, a direct fund sales platform for individual investors. PINE has received positive feedback from investors, specifically millennials and Generation Z, by offering low fees and valuable investment information.

Looking ahead, we will continue to lay the foundation for future growth with a focus on the retirement plan market and alternative investments. We are also actively promoting global businesses and digital financial platforms as we become a comprehensive asset management solutions provider and top–tier asset management company in Asia.

Hanwha Investment & Securities

www.hanwhawm.com- 2023 Total Sales

- 1,448 In USD millions

- 2023 Total Assets

- 9,445 In USD millions

Our expertise

- Securities brokerage, underwriting, asset management

Established in 1962, Hanwha Investment & Securities provides comprehensive asset management services, including brokerage and acquisition of stocks, bonds and derivatives, as well as sales and asset management services for various financial products. With our advanced systems and competitive talent, we have successfully established ourselves as a reliable asset management partner. Our financial products and customer–oriented services are offered both domestically and overseas. We are dedicated to providing sources for stable and diversified income even in the rapidly changing financial environment of digital transformation. In 2021, we achieved record–breaking performances in operating profit and net profit with a significant increase in capital, further strengthening our foundation for future growth.

In wealth management, we provide professional total asset management services. At 12 financial centers across South Korea, we support region–specific sales and customer management, which helps us provide time–efficient decision–making for our customers. Our strategic marketing, content, and digital platforms attract Millennials and Generation Z while also expanding our VIP customer base. Our trading division continues to diversify its income structure, while we quickly respond to the rapidly changing financial environment to improve profitability. We are also improving our operating infrastructure and risk analysis system to secure stable growth. Our wholesale business focuses on domestic and international institutional investors and corporate clients by providing investment information and brokerage services for stocks, bonds, derivatives, and other financial products. Our expertise is well recognized thanks to the high grades we received from major institutions in 2021. As we sharpen our competitive edge, we will continue to grow by expanding global business and diversifying trading products. We are expanding our investment banking business to include domestic and international corporate finance, real estate investment, and infrastructure investment in markets such as Japan, the U.S., and Europe. We will further broaden our business expertise by penetrating the fields of global ESG investment and overseas alternative asset investment.

-

-

Hanwha Investment & Securities continues to strengthen its digital financial platform and actively promote partnerships with, and investments in, fintech companies to spur future growth engines. In 2022, we launched the 1 Dollar Shop, a fractional trading service that lets small investors easily invest in overseas stocks. Following that, we expanded our fintech business through partnerships with PAYCO and Woori Bank. Responding to the changing digital environment, we acquired stakes in Dunamu, a blockchain startup, and Toss Bank, an internet–only bank.

As part of our expanding global operations, we have completed the acquisition of Ciptadana Securities in Indonesia, following our entry into Vietnam and Singapore. Our Vietnam business, established in 2019, achieved an earnings surplus just two years after its launch by offering digital financial services tailored to local customers. These services include the STOCK123 app for customized stock investment education and simulation, the mobile trading system (MTS) ALPHA TRADING app, and E–KYC services that use facial recognition technology. Our corporate entity in Singapore, established in 2020, is contributing to our global business expansion efforts by identifying promising new alternative investment opportunities and unlisted companies within Southeast Asia. With the completion of the acquisition of Ciptadana Securities in Indonesia in 2024, we plan to build a customized digital financial platform for local customers and provide related services. Hanwha Investment & Securities is pursuing the vision of “finance that provides life solutions along with economic prosperity” and will make comprehensive efforts to create value for customers and contribute to the development of the capital market.

Hanwha Savings Bank

www.hanwhasbank.com- 2023 Total Sales

- 90 In USD millions

- 2023 Total Assets

- 1,064 In USD millions

Our expertise

- Deposits, commercial and personal loans

Founded in 1997, Hanwha Savings Bank joined Hanwha Group in 2008, and has since grown into one of the most stable savings banks in the industry. Always putting customers first, we strive to protect their assets and provide high returns.

Exceeding USD 775.55 million in assets in 2020, we then achieved USD 1.06 billion in assets in 2023, maintaining excellent profitability and a sound financial structure. We also found success by extending the fundamental roles of microfinance institutions and supporting small– and medium–sized businesses that show solid potential. Specifically, we develop new products, identify niche markets, and pursue growth in both sales and profitability through systematic risk management.

-

-

We offer differentiated services in corporate business loans, such as business lines of credit, secured loans, PF, ABL, and NPL, by relying on our experienced sales teams and highly disciplined management. We are also preparing for digital transformation in the rapidly changing financial environment as a digital banking operator. We launched the "Mymo" app in October 2022 as part of our innovations in providing customized digital services to Millennials and Gen Z customers, as well as to business owners. Mymo, short for "My Money," is the first app in the industry to feature a "self–managed loan service," which enables customers to reduce interest rates on their own. The app also offers convenient benefits for interest rate reductions as customer credit scores improve. Our customers’ MyMoney balance grows rapidly through our savings accounts, helping them accumulate funds efficiently.

Going forward, we will grow as a top–notch leader in the savings bank industry by enhancing fundamental business capabilities, nurturing digital retail businesses, upgrading corporate finance services, expanding business areas, and discovering next–generation new businesses.

Hanwha Life Financial Services

www.hanwhalifefs.com- 2023 Total Sales

- 1,199 In USD millions

- 2023 Total Assets

- 1,193 In USD millions

Our expertise

- Insurance agency business, life and general insurance products

Launched in April 2021, Hanwha Life Financial Service emerged independently as an insurance sales company from Hanwha Life’s Personal Sales Division. Now, we have more than 500 sales organizations and 21,000 financial planners, positioning us as the nation’s leader in the general agency industry at time of launch. Our vision is to consistently be “the first & next choice for insurance,” and to “enrich customers’ lives.” We are striving to enhance our sales expertise and become the nation’s best insurance sales company.

-

-

We partner with multiple life and general insurers in professional insurance sales. By evaluating coverage, duration and premiums of a range of insurance products, we provide customized services that suit the lifecycles and financial situations of customers. We established rigorous internal control and consumer protection systems that exceed the general level of other corporate insurance agents. By removing misleading and inappropriate sales of financial products, we are taking the lead in protecting the rights and interests of consumers.

As financial planners, we draw on our deep experience and knowledge as the flagship sales channel of South Korea’s first insurance company. We offer excellent sales support systems, including the industry's highest commissions, training processes, expert support, and the benefits of our ACE Club, which honors topranking planners. Since inception, we have achieved stable performance and gained further momentum by recording average monthly insurance sales of USD 4.37 million, giving us the top revenue in the general agency industry. We further solidified our position in the industry in 2023 with our average monthly insurance recruitment performance, which totaled USD 8.12 million.

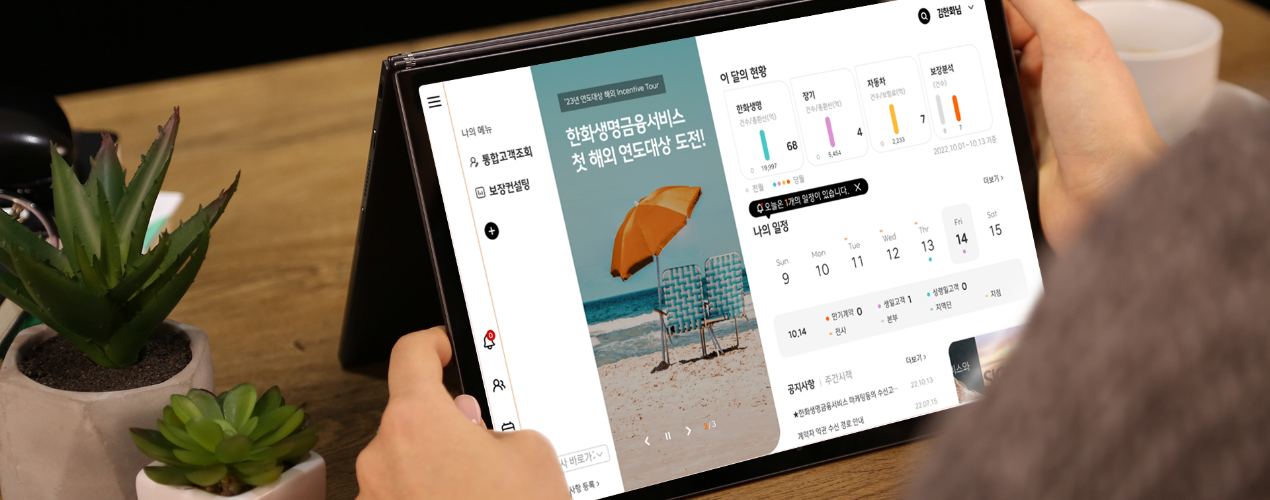

To offer greater convenience to our financial planners, we focused on building a digital platform that links the sales systems of multiple life and non–life insurers. As a result, we have established our two leading digital platforms: Orange Tree, a sales support platform, and Orange Touch, our customer management platform. We plan to facilitate more efficient sales activities by avoiding the need for planners to use each independent system when handling a variety of products. Using these digital platforms, we will create and analyze our own database to further enhance sales competitiveness. We will also continue to develop a customer–centric digital platform to help financial planners and our customers build and maintain friendly relationships.

Hanwha Life Financial Service will increase its financial planners and build new sales channels through the M&A of small– and medium–sized corporate insurance agents. We will continue efforts for qualitative growth by strengthening our hands–on integrated consulting capabilities, expanding our network of experts, and providing education programs to meet the changing financial environment. As we maximize corporate value and further hone our competitiveness by raising capital through an IPO, while expanding our business areas, we will become an insurance sales specialist that provides solutions for all the life needs of our customers.

Carrot General Insurance

www.carrotins.com- 2023 Total Sales

- 399 In USD millions

- 2023 Total Assets

- 304 In USD millions

Our expertise

- Al–digital platform for non–life insurance products

Launched in 2019, Carrot is South Korea’s first fully–licensed 100% digital insurance carrier. Based on a strong foundation of technology and data–driven insights, we are setting new standards for the industry with our innovative products and services, reaching an estimated value of USD 775.55 million, just four years after being established.

-

-

Carrot, which already ranks fifth in the car insurance industry just three years since its launch, has been making remarkable achievements centered on its pay–per–mile program. Under this program, consumers pay only for the number of miles driven at the end of each month, offering a new standard from the existing strict usage–based insurance (UBI) strategy.

With Carrot Plug, customers can measure and check real–time mileage and insurance premiums within the app. In addition, in case of emergency, they can simply press Carrot Plug’s built–in SOS button. Bypassing the need to directly call the insurance company, we have further enhanced convenience for the customer by handling the accident with a call from our customer center. Through tech–based new initiatives such as this, the pay–per–mile program has not only achieved the highest subscription renewal rate in the industry at 91.3% but has also surpassed 1.7 million in cumulative subscriptions.

Carrot’s entirely new approach to insurance is found in non–auto insurance products as well. For instance, the SMART–ON series enables customers to instantly purchase plans without any charge until needed. It can then be turned on with a tap of a button. Carrot includes insurance options tailored to various needs such as overseas travel, pet walking, and leisure activities. In addition, we plan to soon launch an innovative pet insurance that utilizes IoT devices for pets, highlighting our commitment to cutting–edge solutions.

Carrot strives to provide a variety of innovative products and services beyond just insurance. The Carrot Drive Service, which operates via connected data generated from the customer’s driving, not only encourages customers to drive safely by assigning safe driving scores and points, but also actively manages loss ratios. To secure potential customers, Carrot Walk, which can be used by anyone who has signed up for the app, was launched to track walks using a smartphone, prompting safer walking habits while looking out for the health of our users.

Carrot Insurance aims to play a leading role in the digital insurance sector by leveraging its unique data assets. In doing so, we will use connected data to develop new services and products that intertwine with everyday life, further expanding our business areas and creating more innovative experiences for customers.